Since 2018, when the Turkish lira plunged in value, import from Turkey became even more profitable. In 2018 US imports from Turkey reached 10.3bn USD. In 2019 alone the value of imports from Turkey to the EU amounted to 69.8bn EUR. Some of the most often imported products included transport equipment, textile articles, machinery, agricultural products, and more. It is important to note though that when you import, you need to pay customs and value-added tax. The following article focuses on import from Turkey – customs in the EU and the US.

Import from Turkey and customs in the EU

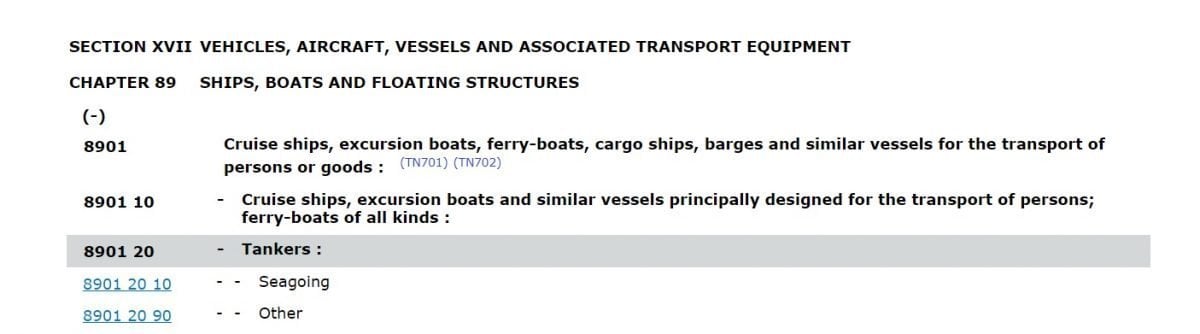

Even though Turkey is not a member of the EU, in 1995 it became a part of the European Union Customs Union. What it means is that in most cases importers from Turkey to the EU do not need to pay customs. This can be clearly seen on the website of TARIC – Integrated Tariff of the European Communities. There, custom codes and customs rates for all EU countries are available. When you find the category of product you are interested in (e.g. with the help of browsing or a textual search), click on its HS code. By clicking “retrieve the measures,” you will be on the product’s site.

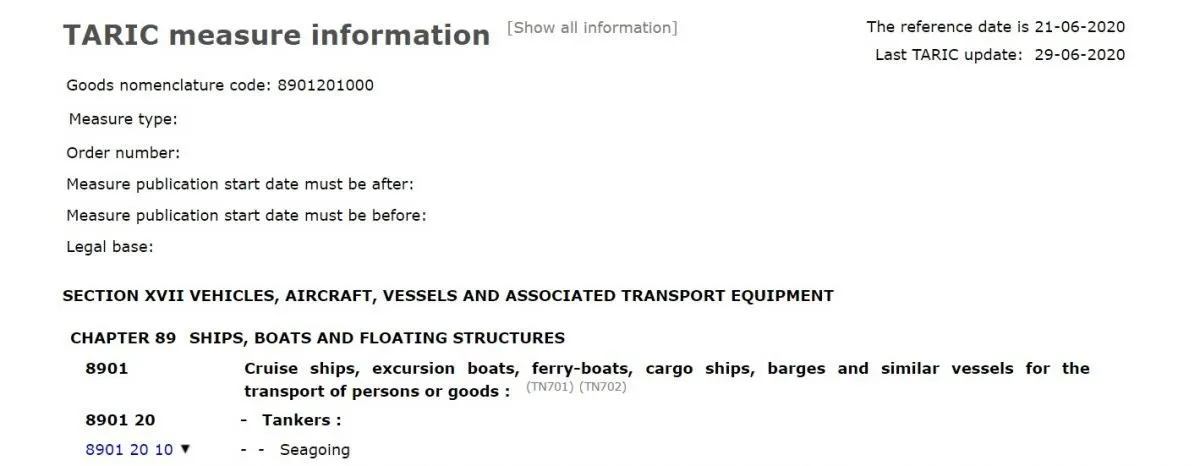

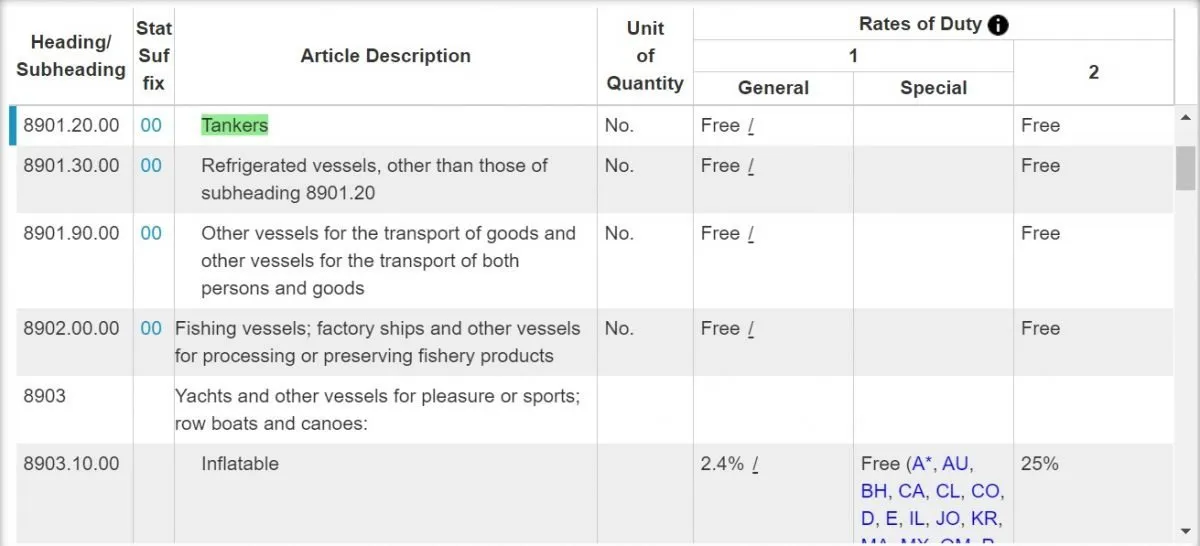

As seen below, if you scroll down the page and find Turkey, you will see “Customs Union Duty: 0%”. Seagoing tankers, just like many other products, are not subject to duties.

The case is more complicated when you want to import agricultural or coal and steel products since they are not covered in the agreement. They are regulated by bilateral trade concessions agreements. Therefore, it is worth checking whether our imported products require us to pay customs. Below are two examples of products that are not covered by the agreement between the EU and Turkey: rye seeds and fresh lemons.

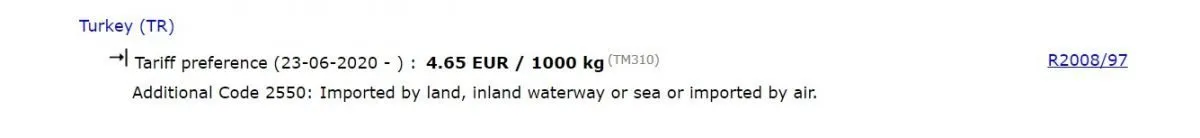

On the bottom of the site of product nr 1002 10 00 00 – rye seeds – importers can find a tariff preference for the above-mentioned product category.

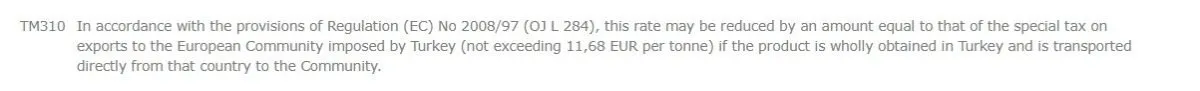

It is equipped with an important reference TM310. In this case, it can mean that paying duties might not be necessary.

On the other hand, in the case of fresh lemons, you can find a much more elaborate tariff preference:

To sum up, in most cases, import from Turkey is treated as an intra-Community acquisition of goods. Therefore, it does not require extra customs charges. Nonetheless, when importing agricultural products or commodities made from coal or steel, you should be careful.

Required documents for import to the EU

In order to import from Turkey and go through customs, you need an invoice and a packing list Sometimes also a certificate of origin or other documents e.g., certificate of compliance, are needed.

While importing from Turkey you must also have documents confirming the preferential status of goods. If you do not have them, you can be forced to pay customs according to duty rates for (products from) third countries. Most agricultural products and all products made from coal or steel require the EUR.1 certificate, the EUR-MED certificate, or invoice declaration.

In order to import or export all other types of products you need the A. TR. Movement Ceriticate.

Import from Turkey to the EU – VAT

It should be noted that even though due to the EU Customs Union you do not need to pay customs, you are still obliged to pay a value-added tax. You need to check its value on a case-by-case basis. VAT differs between countries and depending on the kind of goods.

Import from Turkey to the USA – customs

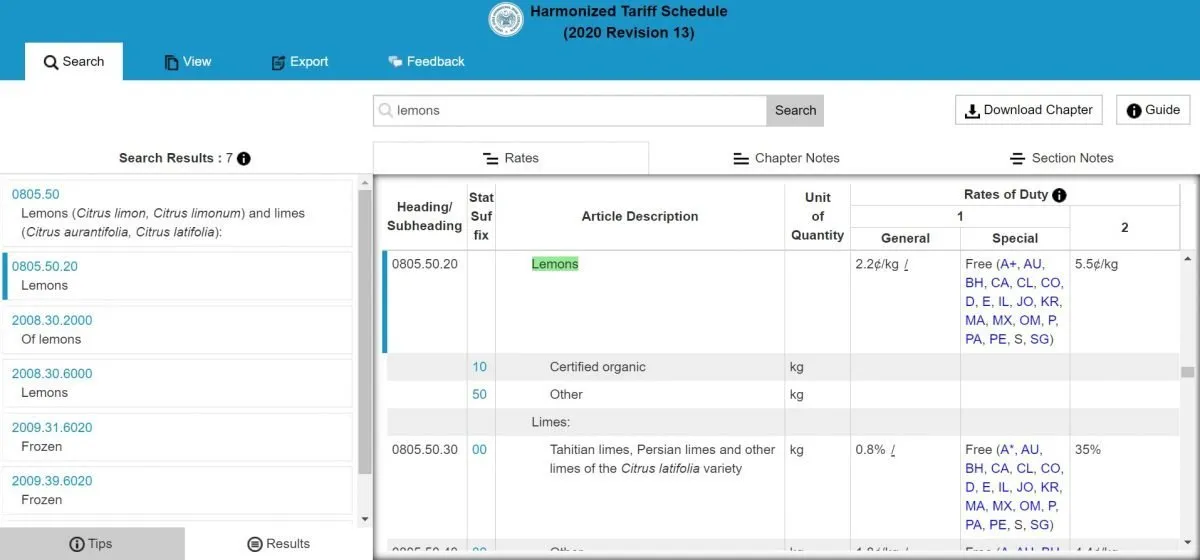

Firstly, it is worth pointing out that the codes used in the EU and in the US are not identical. The US uses the Harmonized Tariff Schedule (HTS) codes, which can be found on the official website.

In the case of Turkey, you usually need to look at the General Rates of Duty. When it comes to lemons, it is 2.2¢/kg /.

In the case of tankers or rye seeds, duties are free.

Required documents for import to the US

Regarding the US, you do not need to have any special documents confirming goods’ preferential status, such as A.TR. in case of importing from Turkey to the EU. However, shipments from Turkey to the US still need to be accompanied by a commercial invoice and a bill of lading or air waybill. Depending on what kind of products you import, other documents might also be needed. They can involve a Certificate of Origin, Control Certificates (in case of animals, animal products and certain plants), import licenses, phytosanitary certificates, etc.

Conclusion

Import from Turkey to the EU can be a lucrative endeavor, especially due to weakened Turkish currency and Turkey’s membership in the EU Customs Union. Nonetheless, you need to take care of all the necessary formalities.