Incoterms are a set of rules defining the terms of sale. Furthermore, people use it all over the world. In addition, these rules share the costs and responsibility between the buyer and the seller. They are used while transporting goods from the seller to the buyer. Incoterms refer primarily to the UN Convention on Contracts for the International Sale of Goods. The latest released version – Incoterms 2010 – has been operating since January 1, 2010. The rules change every 10 years, so soon we can expect new rules – Incoterms 2020.

Changes in 2020

Proposals for changes regarding Incoterms 2020 have already been presented. The official announcement of the modification will be released at the end of 2019, and what is more, the new rules will start operating on January 1, 2020.

The International Chamber of Commerce (ICC) establish the Incoterms rules. This year, the representatives of China and Australia also participated in the exporters’ committee to prepare the new Incoterms rules for the first time.

Division of Incoterms

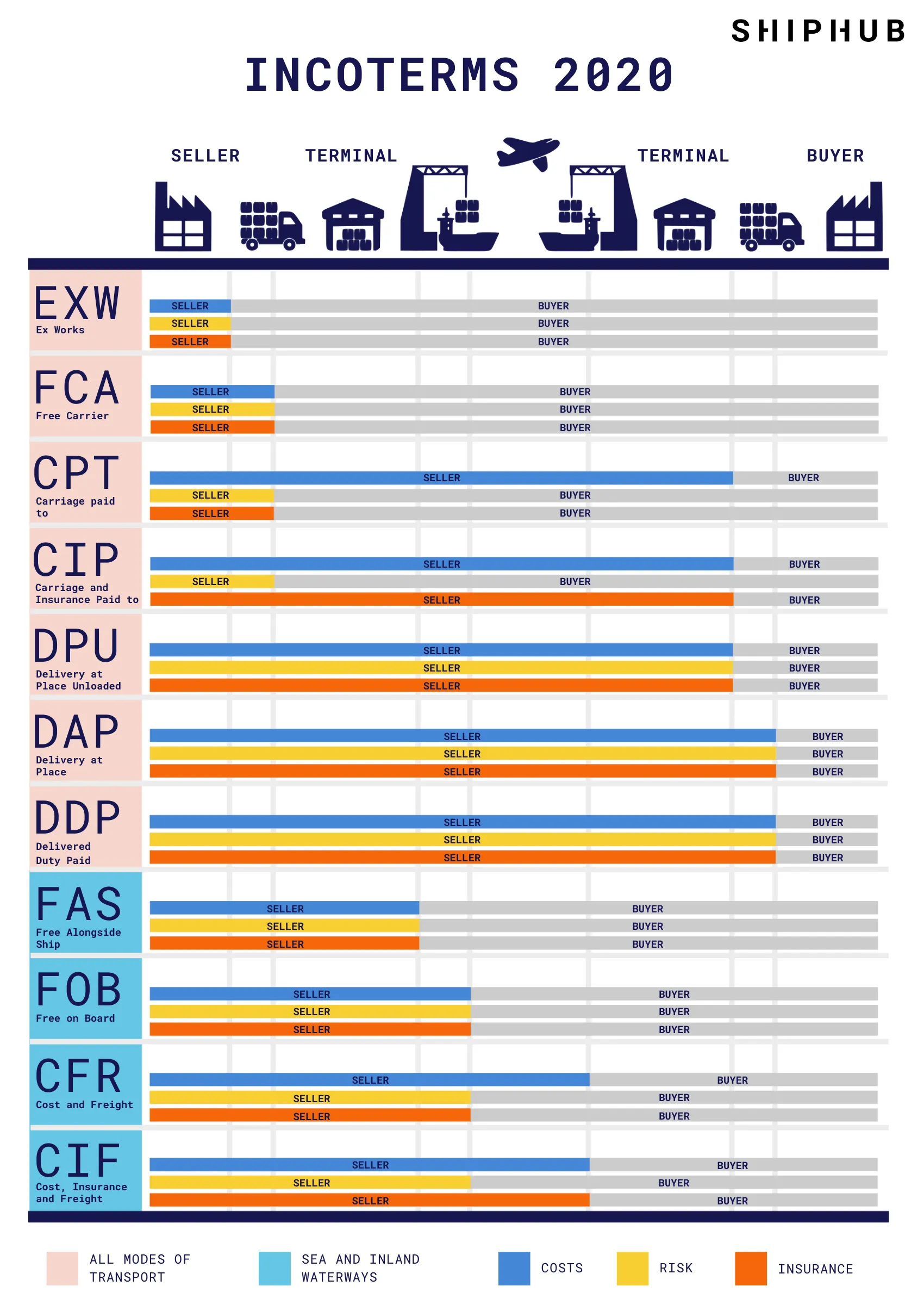

Incoterms 2020 are divided into four groups (C, D, E, F). The rules are classified according to the fees, risk, responsibility for formalities, as well as issues related to import and export.

C Group

In group C (Main Carriage Paid), the seller concludes a transport contract with the forwarder and takes the costs. In this case, the seller is responsible for conducting export clearance. The risk is transferred at the time of posting the goods to the buyer. All matters arising after loading costs related to transporting, and other events, are the buyer’s responsibility. Group C includes the following Incoterms rules: CFR, CIF, CPT, and CIP.

D Group

Group D (Arrival) assumes that the seller is obliged to deliver the goods to a specific place or the port of destination. This group includes such Incoterms as DAP, DPU, and DDP.

E Group

In group E (Departure), the seller makes the goods available to the buyer at the delivery point indicated by the seller. The seller is not obliged either to customs or export clearance and does not bear the risk and costs of loading. In group E, there is only Incoterms EXW.

F Group

Group F (Main Carriage Unpaid) obliges the seller to perform export customs clearance. The seller does not pay transport and insurance costs. FCA, FAS, and FOB belong to this group.

Incoterms 2020 – what will change?

One of the major changes is deleting the DAT rule and replacing it with a DPU.

At first, consideration was also given to removing the EXW rule, but eventually, it remained in Incoterms 2020. The EXW rule gives the most rights to the importer, with the least involvement of the seller.

Another important proposal for change concerns the FCA rule. Incoterms 2020 provides a market need for waybills (BLs) marked on board when applying the FCA (Free Carrier) rule.

FCA rules

FCA is the most common Incoterms rule (approx. 40% of international commercial operations). It is a very versatile rule that allows the delivery of goods to various places (eg address, terminal, port, airport, etc.), which are mostly located in the buyer’s country.

The Committee decided that the FCA rule will provide for two possible places of delivery.

A first variant is a place belonging to the seller (e.g., his warehouse, factory, yard). Delivery is considered complete when the goods are physically transferred (after loading) to the care of a courier or other person designated by the buyer.

However, the second option applies to the place indicated in the contract, which does not belong to the seller (e.g., seaport, terminal). In this situation, the delivery is considered to have been made after the goods have been handed over to the carrier, on the means of transport sent by the seller. It should be noted that unloading goods from the means of transport is not the responsibility of the seller.

Incoterms – CIF, and CIP

Incoterms 2020 aligns different levels of insurance coverage in Cost Insurance and Freight (CIF rules) and Carriage and Insurance Paid To (CIP).

Carriage with own means of transport – FCA, DAP, DPU, DDP

Incoterms 2020 includes arrangements for carriage with own means of transportation in FCA, Delivery at Place (DAP), Delivery at Place Unloaded (DPU), and Delivered Duty Paid (DDP).

Incoterms 2020 – discussions

It may seem that changes to existing Incoterms are not much, but Incoterms 2020 may be easier to understand than Incoterms 2010. The commission wanted to avoid situations where Incoterms are misinterpreted and misused, which is often associated with costly consequences.

The significant differences between Incoterms 2010 and Incoterms 2020 include primarily:

- Bill of lading in the FCA Incoterms rule;

- Cost-sharing issue;

- Organization of transport by the seller’s or the buyer’s means of transport, applying the FCA, DAP, DPU, or DDP rules;

- Change of Incoterms DAT to Incoterms DPU;

- Including safety requirements in the obligation and transport costs;

- Addition of explanatory notes for Incoterms users.