Knowledge of HS customs codes is necessary when importing or exporting goods. That is because the appropriate nomenclature code allows the product to be identified and the customs duties to be determined subsequently. Food is one of the most important areas of the economy. Due to its direct impact on human health and life, it is subject to special regulations.

HS Codes

The World Trade Organization has developed a classification system that is recognized worldwide. The system is updated every 5-6 years in cooperation with the Harmonized System Committee. Therefore, HS codes are used to the national classification of products and to collect global trade statistics.

Sometimes, novice entrepreneurs confuse HS codes with HTS codes (which are in force in the United States). When searching for nomenclature codes, it is worth noting that in some countries (e.g., China or Korea), HS codes are slightly different. To know the difference check our previous article about HS and HTS Code.

HS Code for food

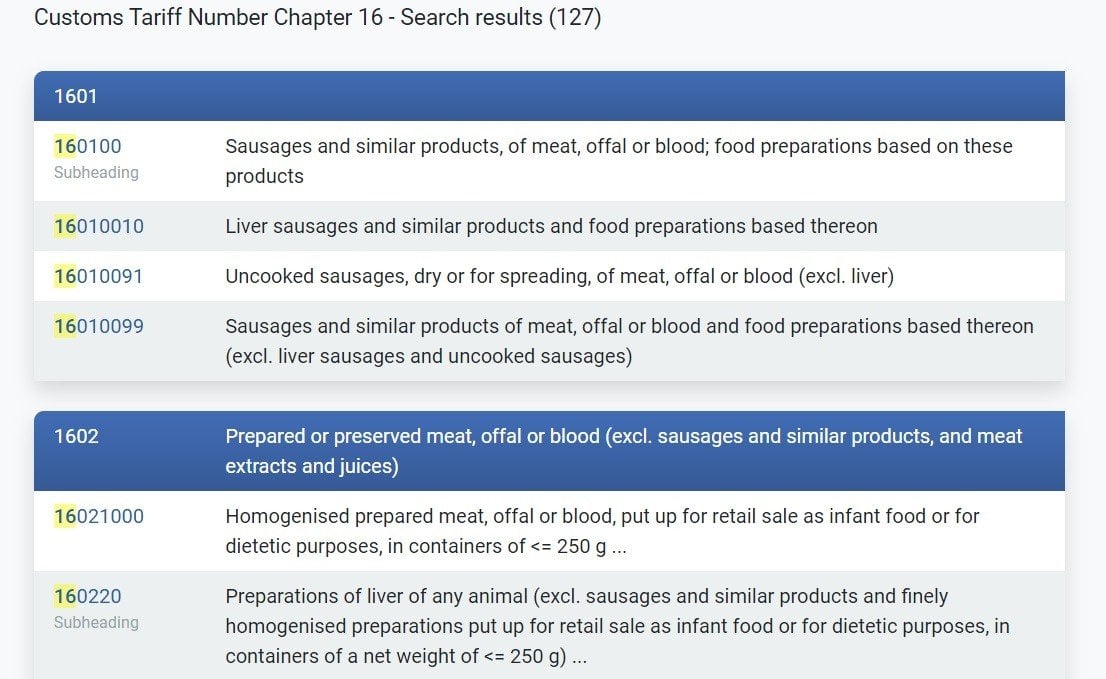

Food can be found in several sections. Especially in section IV, “Prepared food,” chapters 16-21. Besides, you should also pay attention to two other sections in which food products may be located, namely:

Section I “Live animals, animal products”

Section II “Vegetable products”

Section III “Animal or vegetable fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes”

Below you can see how the food group looks compared to others:

Below you can see how the toy chapter looks after expanding:

You can check the full list of HS codes on the official website.

HS CODE for some food products

We present the HS Code and tariffs for sample food products.

1902 40 10 – Couscous, unprepared – 7,7%

1701 12 10 – Raw, beet, sugar – Non-preferential duty under end-use Regulation 1549/06, 33.900 EUR DTN R

1704 10 10 – Chewing gum, whether or not sugar-coated – 6.200 % + 27.100 EUR DTN MAX 17.900 %

1902 11 00 – Uncooked pasta, not stuffed or otherwise prepared, containing eggs – 11%

1905 90 30 – Bread, not containing added honey, eggs, cheese or fruit, whether or not containing in the dry state <= 5% by weight of either sugars or fats – 9,7%

2103 20 00 – Tomato ketchup and other tomato sauces – 10,2%

1905 90 45 -Biscuits (excl. sweet biscuits) – 9.000 % + EA MAX 20.700 % +ADFM

1601 00 91 – Uncooked sausages, dry or for spreading, of meat, offal or blood (excl. liver) – 149.400 EUR DTN

2001 10 00 -Cucumbers and gherkins, prepared or preserved by vinegar or acetic acid – 17,6%

Knowledge of codes and documents

Although knowledge of HS Codes turns out to be very useful, it is not enough in import or export of food. HS Codes make it easier to set the customs rate or check applicable VAT, but in the case of food, you must also make sure that you have all the necessary documents and certificates.

You can also check our previous article about HS Code for toys.