The Harmonized Commodity Description and Coding System, also known as the Harmonized System (HS) of tariff nomenclature is an internationally standardized system of names and numbers to classify traded products. The nomenclature covers 5000 groups of goods. Knowledge of HS Code is useful when importing and exporting goods. Recently, the import of toys is very popular, which is why we have prepared information on HS CODE for toys.

HS Code

The classification system has been developed and is maintained by the World Trade Organization. The HS number is recognized worldwide and is mainly used for the national classification of products and collecting statistics on global trade.

Each product group has a subordinate six-digit code that facilitates the identification of the goods. The system is updated every 5-6 years by the World Customs Organization and the Harmonized System Committee.

HS Code for toys

The toys belong to section XX, Chapter 95 (toys, games and sports requisites; parts and accessories thereof).

Below you can see how the toy group looks compared to others:

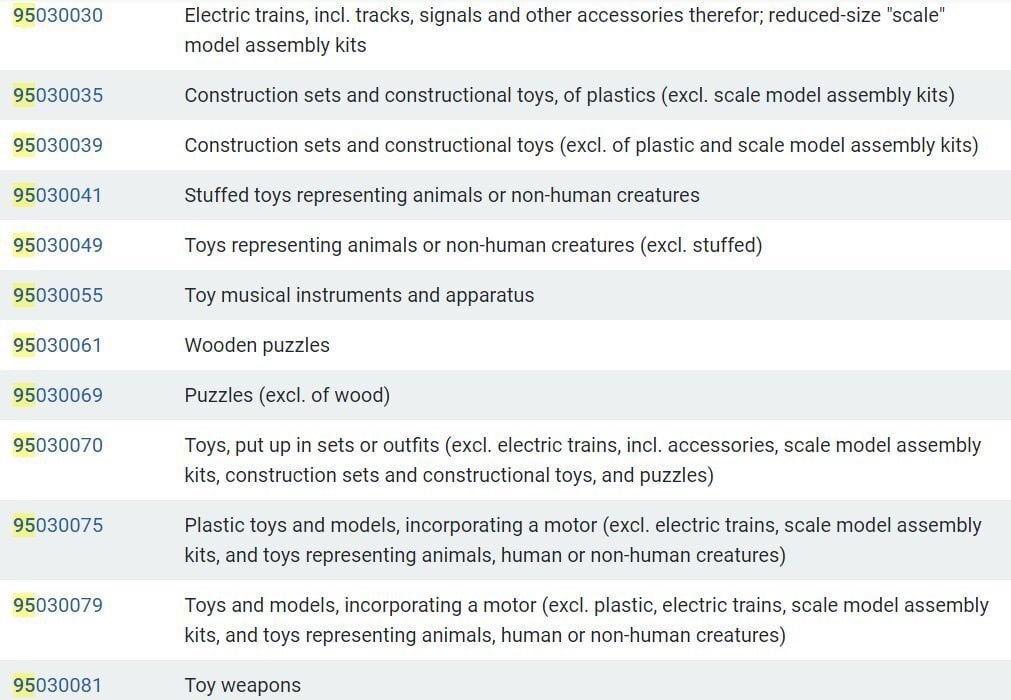

Below you can see how the toy chapter looks after expanding:

You can check the full list of HS codes on the official website.

Sample HS code for toys

We present the HS CODE codes and tariff rates for sample toys:

95 03 00 21 – 4,7% – Dolls representing only human beings, whether or not clothed,

95 03 00 10 -0% – Tricycles, scooters, pedal cars and similar wheeled toys, and dolls’ carriages (excl. normal bicycles with ball bearings),

95 03 00 41 – 4,7% – Stuffed toys representing animals or non-human creatures,

95 03 00 61 – 0% – Wooden puzzles,

95 03 00 55 – 0% – Toy musical instruments and apparatus,

95 03 00 70 – 4,7% – Toys, put up in sets or outfits (excl. electric trains, incl. accessories, scale model assembly kits, construction sets and constructional toys, and puzzles),

95 03 00 30 – 0% – Electric trains, incl. tracks, signals, and other accessories therefor; reduced-size “scale” model assembly kits,

95 03 00 35 – 4,7% – Construction sets and constructional toys, of plastics (excl. scale model assembly kits).

Knowledge of relevant codes

Knowledge of codes can help with import and export. As a result, it will be easier for us to find tariff rates, applicable VAT charges, as well as obtain information on the inter-state exchange of goods.

Note that in some countries (e.g., China or Korea), HS codes are slightly different. Furthermore, do not confuse HS codes with US HTS codes. To know the difference check our previous article about HS and HTS Code.