The US is the biggest importer in the world. US largest trade partner is China; therefore, the US market is flooded with Chinese goods. Still, for many importers clearing Chinese goods in the US is tricky. This article discusses customs clearance from China in the US.

Customs clearance from China in the US

Clearing customs involves preparing paperwork to import goods and paying applicable tariffs. The importer should manage most of the customs clearance, but working with a licensed customs broker is a good idea. In the US case, a formal entry for shipments valued over 2,500 USD requires a broker, and at any value if the consignment consists of controlled goods.

Customs clearance in the US – customs entry

The entry procedure consists of the following steps:

- The shipment arrives at the port of entry.

- The Importer of Record (IOR) files entry documents for the goods with the port director at the goods’ port of entry.

- If the documentation is in order, the delivery is authorized by the CBP.

- Any duties and fees are paid in the full amount.

- Cargo may be subject to an intensive examination.

- The goods are released.

For more details, feel free to read our article on clearance in the US.

US customs tariffs on Chinese goods

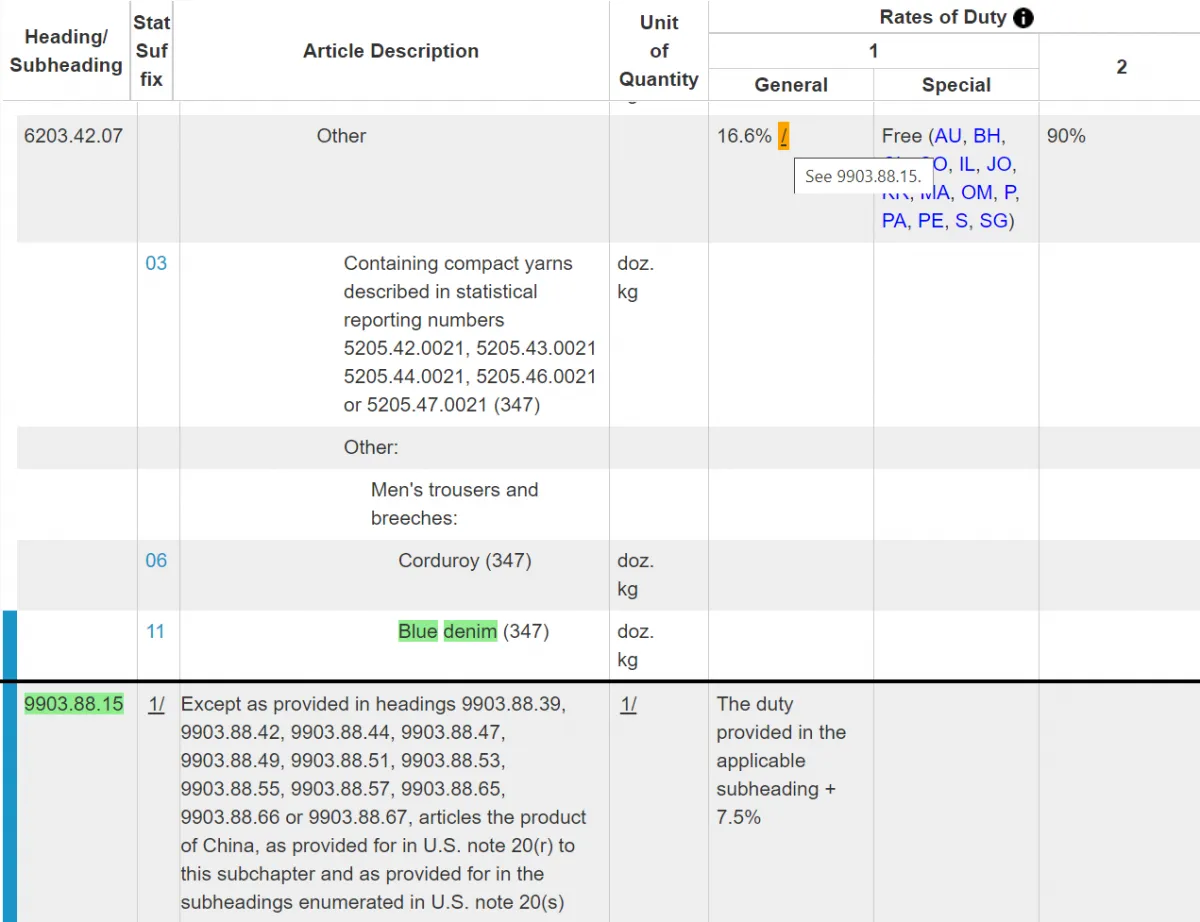

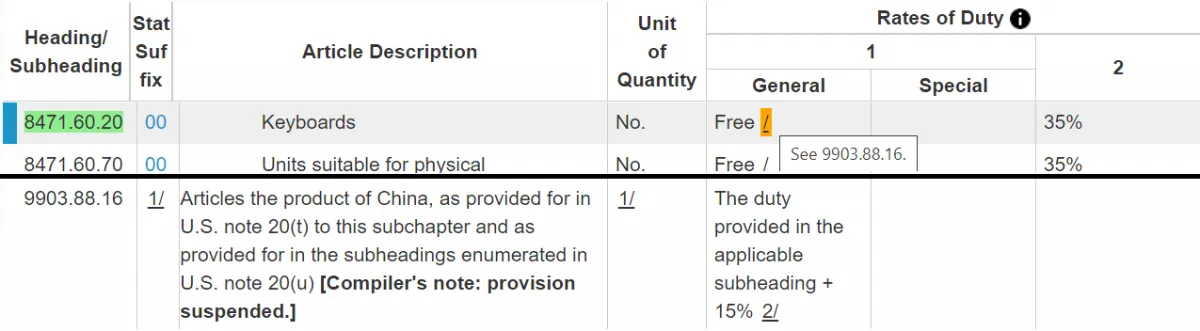

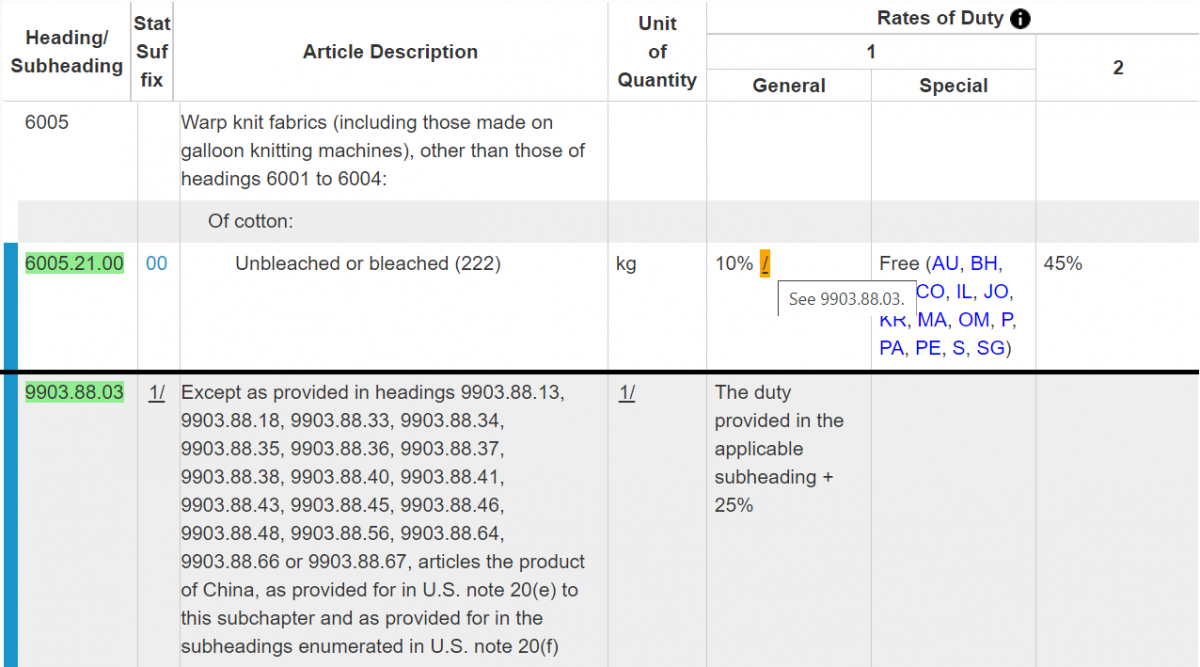

Tariffs are taxes levied against the imports’ commercial value upon import and depend on the country of origin. Tariffs imposed on products imported into the US are available on the Harmonized Tariff Schedule website, HTS for short. Each HTS code in the schedule, which identifies every product group based on the international Harmonized System, has an assigned customs duty rate. The complete code consists of ten digits.

Bear in mind that products from China imported into the US have an additional duty of the general rate, so-called “China tariffs” or “Section 301 tariffs.” Such tariffs cover around 60% of US imports from China. The 301 tariffs do not apply to goods from Taiwan, Hong Kong, and Macau. Click the link to see the list of tariff numbers for additional duties on from China.

Let us look at some examples of goods imported into the US from China:

- Men’s trousers and breeches of blue denim (code 6203.42.07.11), general duty rate is 16.6%, China tariff rate is 7.5%

- Keyboards (code 8471.60.20.00), general duty rate is 0%, China tariff rate is 0% (the 15% has been removed since February 2020)

- Warp knit fabrics of dyed cotton (code 6005.22.00.00), general duty rate is 10%, China tariff rate is 25%

Before importing, check the current tariff rates on the HTS website.

There are excise taxes on tobacco and alcohol. Both the state and federal governments impose taxes.

Customs clearance from China in the US – documents

The US Department of Customs and Border Protection (CBP) is the agency that enforces the laws and regulations for all imports and related paperwork. To clear the goods, you have to provide a set of documents such as:

- official commercial invoice that lists the purchase price, country of origin, HTS code and more

- packing list (P/L)

- arrival notice authorized by a US Customs Agent

- ISF 10+2 (if cargo arrives by ocean vessel)

- CBP Form 3461 (Customs Release) and CBP Form 7501 (Customs Entry Summary)

- bill of lading (ocean freight)

- customs bond (acts as an insurance policy), whether single entry bond or continuous bond, when the imports are valued at more than 2,500 USD or subject to a federal agency’s oversight.

For some goods from China, you might need an import permit. Here is a list of several federal agencies that oversee certain goods:

- Food and Drug Administration (FDA) – food, cosmetics, medication, housewares, food-related items, health devices, and more.

- Environmental Protection Agency (EPA) – chemicals.

- Consumer Product Safety Commission (CPSC) – toys and children’s products.

- Department of Transportation (DOT) – cars and motor vehicles.

- US Department of Agriculture (USDA) – plants, plant products, wood, animals and more.

- Federal Trade Commission (FTC) – various parts of the import process, including product labeling and more.

- Alcohol and Tobacco Trade and Tax Bureau (TTB) – alcohol and tobacco products.

How much does it cost to ship goods from China to the US?

Do you find it challenging to find the right freight forwarder? You can easily compare freight rates on ShipHub.co! Get quotes for your shipment for free and choose the best one for you.