Mexico is an industrial and agricultural state that is dynamically developing. It’s famous, among others, for producing food products, including vegetables, fruits, and cereals. Moreover, Mexico is a country rich in mineral resources, such as oil and gas. Many companies from the US saw the immense potential in Mexico and decided to use it by manufacturing their goods in this country. We discuss importing from Mexico – duty rates, requirements, and transport.

What can I import from Mexico?

Trade between Mexico and the US

Mexico is the United States’ largest goods trading partner. In 2019, export from Mexico to the US reached about $358 billion, making the country Mexico’s most significant export market. Mexico’s exports to the US show an upward trend and increased between 2009 and 2019 by 102.6%. Such a vast difference is mainly due to more and more US companies starting to manufacture their goods in Mexico. However, it’s worth noting that Mexico is also one of the largest export markets for the US. For comparison, the US’s exports to Mexico in 2019 totaled $256.6 billion.

Trade between Mexico and the EU

Mexico ranks 15th among the primary import markets of the European Union. Its largest trade partner from the EU is Germany, both in imports and exports. The trade agreement signed by Mexico and the European Union in 2000 created great opportunities for the EU entrepreneurs. Thus, more and more of them take a closer look at the possibilities in Mexico and decide to import from Mexican suppliers.

What does Mexico export?

- Vehicles;

- Machinery and electrical machinery;

- Agricultural products;

- Medical instruments;

- Mineral fuels;

- and more.

Importing from Mexico – Duty rates in the US

Before organizing imports from Mexico, every entrepreneur must check customs rates for the chosen products. Duty rates and HTS codes for importing into the US can be found on the Harmonized Tariff Schedule website. It’s a free-to-use, reliable source where importers can find up-to-date information about duty rates. Enter the article’s name in the search bar or, if you know them, the first 4 or 6 digits of its code.

Below we have prepared some examples of duty rates for most often imported products from Mexico:

Motor vehicles for the transport of goods (8704.10.50) – 0%

Motor vehicles for the transport of ten or more persons, including the driver (8702.10.61) – 2%

Portable automatic data processing machines, weighing not more than 10 kg, consisting of at least a central processing unit, a keyboard and a display (8471.30.01) – 0%

Vacuum cleaners (8508.11.00) – 0%

Air conditioning machines (8415.10.30) – 0%

Importing from Mexico – Duty rates in the EU

When it comes to importing from Mexico to the EU, you can check duty rates and HS codes for goods in the TARIC system. It’s completely free and contains current data concerning tariffs. Such information is necessary for customs clearance in the European Union.

Check the duty rates for most imported goods from Mexico to the EU:

Portable automatic data-processing machines, weighing not more than 10 kg, consisting of at least a central processing unit, a keyboard and a display (8471300000) – 0%

Petroleum oils and oils obtained from bituminous minerals, crude (2709001000) – 0%

Motor vehicles for the transport of goods (8704109000) – 0%

Motor cars and other motor vehicles principally designed for the transport of persons (other than those of heading 8702), including station wagons and racing cars, of a cylinder capacity not exceeding 1 000m3 (8703211000) – 10%

Coffee, not roasted (0901110000) – 0%

Coffee, roasted (0901210000) – 7.5%

Documents for importing from Mexico

When importing goods from Mexico to the US or the EU, knowing the target market’s requirements is crucial. An importer must ensure that they have all the necessary documentation, certificates, and markings. Some of the documents are required for all types of goods, while others will be necessary only for some of them. Therefore, before the import, it’s essential to know all the regulations for your products to be sure that you have all the mandatory documents and marks.

US Requirements

Required documentation:

- Commercial Invoice – obtained from an exporter;

- Packing List;

- Bill of Lading (B/L, BOL) – for sea freight;

- Air Waybill (AWB) – for airfreight;

- Entry Manifest (CBP Form 7533);

- COO (Country of Origin) Label.

The United States doesn’t have a standardized law that states the market’s requirements for imported goods. However, some organizations develop norms for various goods regarding safety, quality, or other factors. Thus, before import, you must check if your products must comply with any regulations, e.g., from the CPSC organization.

EU Requirements

Required documentation:

- Commercial Invoice – obtained from an exporter;

- Packing List;

- Bill of Lading (B/L, BOL) – for sea freight;

- Air Waybill (AWB) – for airfreight;

Documents required for certain products:

- Test reports, the CE Certificate, Declaration of Conformity – e.g., for electronics, electrical appliances, machinery, medical equipment, and toys;

- Certificate of Origin – e.g., for textiles and agricultural products;

- Fumigation Certificate – for raw wood products (e.g., packaging and pallets);

- CITES Certificate – e.g., for products of animal origin or specimens of fauna and flora;

- and others.

Importing from Mexico – Transport

Sea freight

Sea transport is the most often chosen delivery method in international trade. It’s a result of its relatively low costs (the cheapest way of transit) and the possibility of packing the cargo into a container. Sea freight is also known for its biggest carrying capacity. Thus, it can be used to transport nearly all kinds of products. However, one must keep in mind that the transit time for such delivery will be the longest.

When transiting your goods by sea, you can choose between FCL (Full Container Load) and LCL (Less Container Load) transportation. Therefore, you can decide to use the total capacity of a container (FCL) or only its part (LCL). Your decision should depend on the type of your cargo, its measurements, shape, and amount.

Airfreight

Airfreight is not as often used as sea transport. The primary reason for this is its high price (the highest among all available methods). Nonetheless, it’s worth considering the two main advantages of transporting by air – safety, and speed. There is no faster way of transport than by plane. Thus, air freight is most often chosen to deliver cargo that must reach its destination as quickly as possible (e.g., food and pharmaceuticals). Furthermore, it also works well in transporting valuable goods (e.g., luxury cars or jewelry).

Cargo ports in Mexico

When organizing transportation from Mexico, it’s worth checking from where you can transit your cargo. We have prepared a short list of the most significant seaports and airports located in Mexico to make this easier for you. You can check their localization on the maps below.

Most significant cargo seaports in Mexico:

- Altamira;

- Manzanillo;

- Lázaro Cárdenas;

- Veracruz;

- Ensenada.

Most significant cargo airports in Mexico:

- Mexico City International Airport (MEX);

- Cancún International Airport (CUN);

- Guadalajara International Airport (GDL);

- Monterrey International Airport (MTY);

- Toluca International Airport (TLC).

Road and intermodal transport from Mexico to the US

Importers from the US have two additional options for transport from Mexico – road and intermodal transportation. Both of these methods are good alternatives to the previously mentioned ways. Firstly, they are both cheaper than the costly air freight, and secondly, faster than the sea transit. Moreover, they enable door-to-door delivery, which is more efficient and cost-saving.

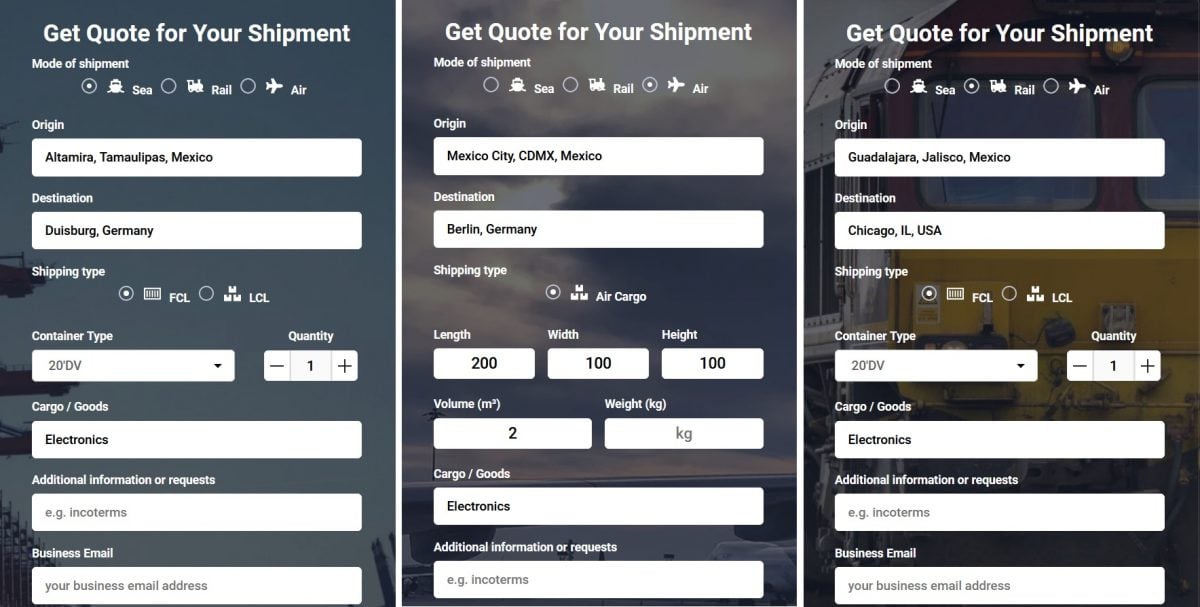

Costs of transport from Mexico

The final cost of transport will differ depending on the cargo’s type, amount, size, chosen route, method of transportation, freight forwarder, and a few other factors. Therefore, it’s worth checking and comparing at least a few offers from various forwarders before making the decision. You will find freight operators on our free-to-use platform ShipHub.co. Fill in the form on the home page, as presented in the picture below. Following, you will receive offers from the forwarders.

Importing from Mexico – Summary

- Mexico is the United States’ largest goods trading partner.

- More and more importers from the US decide to manufacture their goods in Mexico.

- Among the European countries, Germany is Mexico’s biggest export market.

- Remember to check the duty rates for your goods in the US or the EU.

- Please note that it is your obligation to gather all the necessary documents and certificates.

- Before arranging a shipment from Mexico, see the offers of at least a few shippers available on ShipHub.