2020 and 2021 were the most profitable two years in shipping history. Seeing the astronomical profits, shipowners decided to order many new vessels. Therefore, we can expect a lot of new container ships in 2023 and 2024 out at sea.

New container ships

Even though we recently experienced a slump in container freight rates, we keep seeing interest in ordering new container ships. However, it may be difficult to absorb all these new ships when they hit the water.

According to the estimates, the current order book represents 30% of the existing tonnage. The numbers broke the previous record in 2008 when 6.6 million TEUs were ordered. As of now, the container ship order book stands at 7.1 million TEUs for 2023-2024. It also means 2.6 times higher deliveries than average.

On-order tonnage:

- 1.1 million TEUs in 2021

- 1.1 million TEUs in 2022

- 2.34 million TEUs in 2023

- 2.83 million TEUs in 2024.

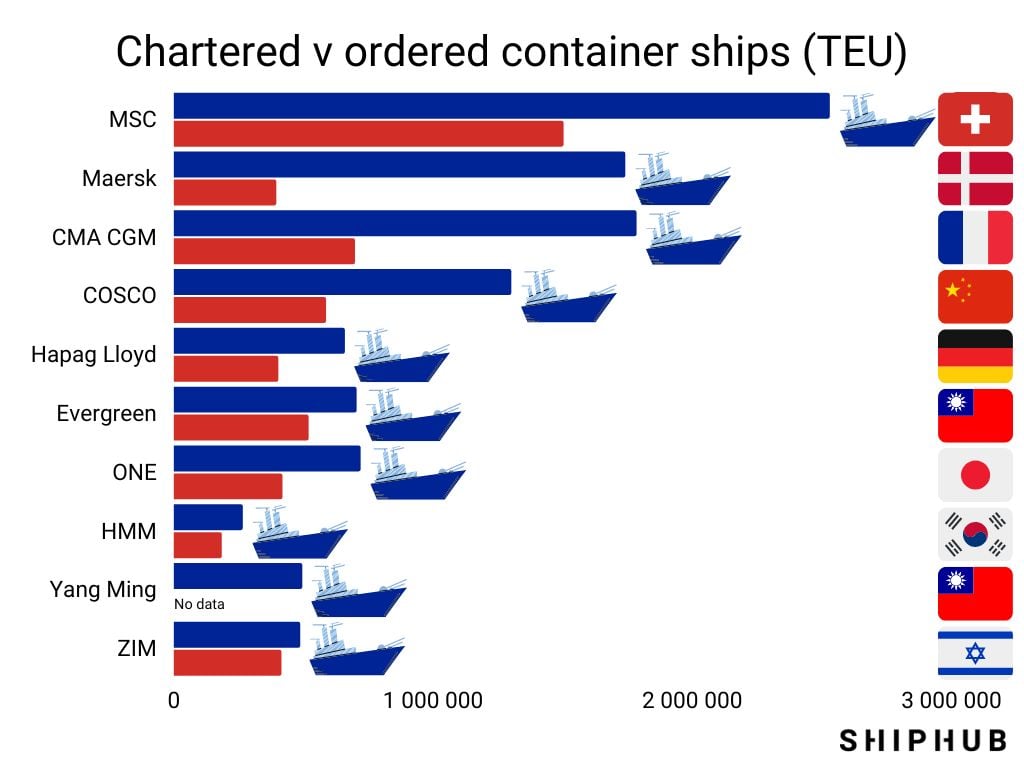

Top operators by TEUs and share of the existing fleet

- Mediterranean Shipping Company (MSC) – 17.4%; ordered 110 ships (1.5 m TEUs)

- Maersk – 16.5%; ordered 34 ships (395 thous. TEUs)

- CMA CGM – 12.9%; ordered 79 ships (698 thous. TEUs)

- COSCO – 11.1%; ordered 34 ships (586 thous. TEUs)

- Hapag-Lloyd – 6.8%; ordered 21 ships (402 thous TEUs)

- Evergreen Line – 6.2%; ordered 54 ships (518 thous. TEUs)

- Ocean Network Express (ONE) – 5.8%; ordered 30 ships (418 thous. TEUs)

- HMM – 3.2%; ordered 17 ships (184 thous. TEUs)

- Yang Ming – 2.7%; no data

- ZIM – 2%; ordered 46 ships (413 thous. TEUs)

What are the new container ships?

Shipowners are concerned about rising fuel prices. Therefore, about 29% of the capacity of ordered container ships is dual fuel. It means that the vessel can burn liquefied natural gas or methanol in addition to traditional marine bunker fuel.

What happens to the old ships?

In 2021-22 there were very few scrapped container ships because the freight rates were high, and it would be non-economical. The forecast says the demolitions of old ships in 2023 will be high, but the value of scraps will be relatively low.